Overview

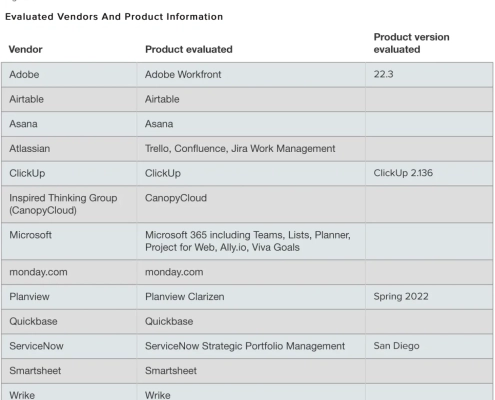

In Forresters’ 30-criterion evaluation of collaborative work management (CWM) providers, we identified the 13 most significant ones – Adobe, Airtable, Asana, Atlassian, CanopyCloud (Inspired Thinking Group), ClickUp, Microsoft, monday.com, Planview, Quickbase, ServiceNow, Smartsheet, and Wrike – and researched, analyzed, and scored them. This report shows how each provider measures up and helps collaboration professionals select the right one for their needs.

A FORRESTER WAVE PUBLICATION BY MARGO VISITACION | DECEMBER 2022

CWM Takes Its Place As An Enterprise App

Once considered a team tool for easy project management, the advent of the pandemic created an opportunity for CWM tools to rapidly expand to enterprise levels of adoption. Flexible user-driven configurability enables users to adapt the products to a wide variety of use cases, often replacing formal planning tools or disconnected spreadsheets. As adoption continues to grow, user demand for more enterprise-ready features such as capacity planning, financial tracking, and deeper analysis has created opportunities and challenges, such as retaining ease of use while offering more powerful capabilities. As a result of these trends, CWM customers should look for providers that:

Support a wide range of work types for activity management

Organisations need to connect digital workers regardless of location to automate project or process work. Vendors offer out-of-the-box work types for various kinds of projects as well as support for help desk, CRM, and strategy planning. Without requiring coding, users can design personal or organisational work spaces, assign activities, and connect with internal or external contributors to collaborate on digital content. Increasingly powerful graph data architecture no longer requires an end user to work in a task management construct, enabling even broader and more complex event handling for work management.

Manage work at scale in terms of capacity and complexity

With customers having thousands of users, scalability is no longer an issue for vendors in the market. Managing work at scale has expanded emphasis on providing capabilities that also allow users to scale vertically to manage larger, more complex initiatives. While not yet a full replacement for enterprise portfolio tools for top-down planning, CWM tools introduce light portfolio-level capabilities, enabling the ability to roll up data for macro-level reporting. This, combined with continued ease of use, allows for greater transparency into actual performance.

Improve analytics and work visualisation

In the early days of the CWM market, reporting was limited to filtering and sorting information across work spaces. With enterprise adoption, the demand for stronger analytics has pushed the vendors to build more sophisticated analytics for visualising how work is managed. Expanded analytics allow for more sophisticated dashboard analytics, and integration with business intelligence (BI) tools are now standard to support enterprise reporting needs.

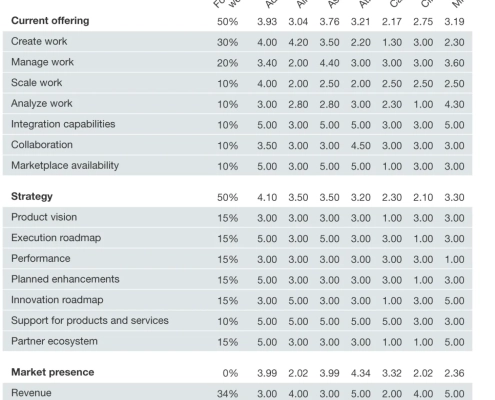

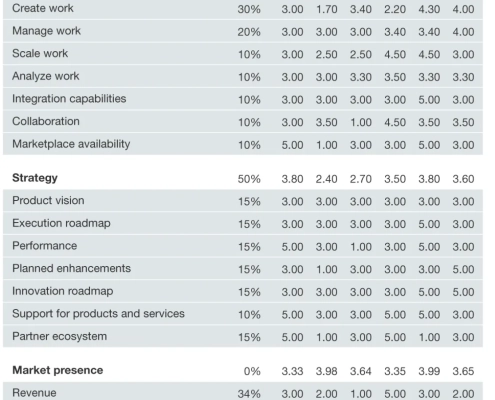

Evaluation summary

The Forrester Wave™ evaluation highlights Leaders, Strong Performers, Contenders, and Challengers. It’s an assessment of the top vendors in the market; it doesn’t represent the entire vendor landscape. You’ll find more information about this market in our reports on collaborative work management. We intend this evaluation to be a starting point only and encourage clients to view product evaluations and adapt criteria weightings using the Excel-based vendor comparison tool (see Figures 1 and 2). Click the link at the beginning of this report on Forrester.com to download the tool.

Forrester included 13 vendors in this assessment: Adobe, Airtable, Asana, Atlassian, CanopyCloud, ClickUp, Microsoft, monday.com, Planview, Quickbase, ServiceNow, Smartsheet and Wrike.

Click on the charts and tables below to view them at a larger size.

Forrester Wave™: Collaborative work management tools, Q4 2022

LEADERS

ADOBE

Adobe Workfront remains the leader in the market. Workfront, acquired by Adobe in 2020, offers CWM at the enterprise level with an emphasis on financial services, healthcare, and retail. Workfront’s primary audience is marketing, but the product’s flexibility supports multiple work management use cases. As a result, it is the fastest-growing solution in Adobe’s XD offering. Strategically, the vendor differentiates itself with its robust architecture that supports multiple personas from executives to team members, connecting disparate work in a single ecosystem to align strategy with delivery regardless of approach. The product focuses more on planned work than ad hoc work, but users can manage individual work spaces. Adobe Workfront excels in work creation, asset creation and management, and support for work at scale in global deployments. Lagging are its container approach that constricts cross-organisational collaboration as well as a competent, but not outstanding, innovation roadmap. Reference customers noted that Adobe’s flexible work creation is robust and customer support has significantly improved since the Adobe acquisition, but they want better notifications and data exports. Adobe is a good choice for an organization that requires enterprise CWM with marketing, IT, and general business support.

SMARTSHEET

Smartsheet outpaces competition with the broadest set of available work types. Founded in 2006 in Bellevue, Washington, Smartsheet continues to provide an extremely broad set of use cases among the Leaders in this Forrester Wave. Team-level entry and viral adoption remain the typical entry point, but the vendor’s strategy to provide a flexible platform with enterprise-ready modules and pricing tiers makes adoption relatively frictionless. Smartsheet made the enterprise leap with smart acquisitions that allow the vendor to be the most portfolio-ready player to compete with project portfolio management (PPM) and strategic portfolio management (SPM) vendors as well as in the marketing world. The familiarity of the UI allows support of any market need, with particular emphasis in healthcare, high-tech, and professional services in the US, EMEA, and Asia-Pacific. Smartsheet’s execution is a particular strength, but its partner ecosystem lags others evaluated. Smartsheet’s strengths are the extensive availability of work types, flexible use-case creation, and end-user automation capabilities. Lagging are the average knowledge management capabilities and limited partner network. Reference customers love the ease of use, ability to scale, and highly innovative support teams but feel that pricing has gotten too complex. Slowing trial functionality also potentially impacts enterprise adoption. Smartsheet is a good choice for enterprises needing a broad set of use cases.

ASANA

Asana’s goal-oriented approach drives greater enterprise adoption. Founded in San Francisco in 2008, Asana focuses on being the navigation system for work in the enterprise. Most strongly represented in North America and EMEA in high-tech products, media, and retail, the vendor seeks to be the GPS for the organization by targeting key personas such as business leaders, the office of the CIO, and program management. Strategically Asana differentiates itself in two areas: 1) Its proprietary Work Graph data model connects information, people, and objectives that drive work through the organization and 2) its goal management structure helps organisations connect disparate teams with a common focus. Asana’s market presence reflects CWM’s hybrid market makeup. The vendor experiences robust revenue growth. Even though most of its customers are small seat implementations, they account for less than a third of the company’s revenue. Asana’s partner network is a weakness relative to others’ evaluated. Asana excels in performance management and objectives and key results (OKR) capabilities. Other strengths include work visualization and integration. Portfolio and financial management need to evolve. Reference customers note the product’s flexible accessibility works well for hybrid organisations. They like the OKR support, company leadership, and product support but get frustrated with the vendor’s work graph construct that doesn’t allow them to capture the impact of tasks outside of a project — these tasks must be tracked separately. Asana is a good choice for organisations looking to link strategic objectives with planned work.

WRIKE

Wrike’s strategy and product offering show resiliency in enterprises. Wrike, spun off from Citrix in 2022, has a hybrid product/sales model but strategically focuses on large enterprises. Founded in 2006, the vendor is one of the earliest entrants in the CWM market and possesses a mature offering that serves both small teams and enterprise implementations. Wrike’s strategy is to support universal workflows with autonomous teams and thus has strong revenue growth with deal sizes of $100,000 or more in enterprise customers. The vendor mostly has a horizontal customer base but emphasizes consumer products, high-tech products, and professional services with greatest representation in North America and EMEA. Wrike’s strengths include asset creation and management, project management, collaboration, and performance management. Current offering weaknesses include portfolio and resource management. The vendor trails competitors in marketplace availability. Reference customers noted that Wrike excels in project management automations, data capture for reporting, and customer support. But they feel that the product needs to improve notifications and provide stronger agile support and that the BI interface is overly complex for standard reporting. Wrike is a good choice for organisations seeking robust, but easy-to-use, project management tools.

STRONG PERFORMERS

MONDAY.COM

monday.com is strong at the team level but lacks maturity for enterprise use. The vendor, founded in 2014 and headquartered in Tel Aviv, continues to aggressively pursue its strategy of building an operating system to support enterprise work. Monday.com offers a no-code base that targets a wide range of business and technology personas to manage work whether planned, ad hoc, or process-driven. It works well horizontally and for simple top-down planning. However, it still needs to mature to support enterprise work management. Most frequently represented in North America and EMEA, the vendor exhibits solid revenue growth and strong customer satisfaction scores. monday.com’s strengths are easy work creation and organization of available work types. Its ability to visualize work attracts many potential use cases, and the marketplace allows augmentation of capabilities within the Work OS platform. Weaknesses include performance issues such as large project scaling, issues with enterprise account support for integration, and Google Calendar support. Reference customers like monday.com’s ease of use and the ability to support a wide range of use cases, allowing them to get off email, but noted that the speed of updates caused unintended glitches in the product. Monday.com is a good choice for organizations to standardize common solutions at the team level.

SERVICE NOW

ServiceNow has platform power but does not have strength in ad hoc work management. ServiceNow, founded in 2004 in Santa Clara, California, offers a flexible low-code platform for its customer base. Acting as the platform for digital business, it offers all the capabilities to support collaborative work via workflow design and task management, but it over-pivots to planned work by positioning SPM to manage planned work versus connecting ad hoc and planned in a holistic manner. Globally positioned with emphasis on North America and EMEA, the vendor continues to exhibit robust revenue growth as it continues to invest in its products, but the vendor must focus more on how to holistically resolve work management challenges. ServiceNow excels in agile, enterprise support, portfolio, performance, and resource management but lags in the end-user ability to create work types and ad hoc task management within projects or in process management. Reference customers cite the benefits of having a single low-code platform that provides better data accessibility and insight for metrics management but would like the product to have better integration with other collaboration and easier management of ad hoc work. SPM doesn’t handle it well, so they need a virtual task board that doesn’t automatically roll up. ServiceNow is a good choice for ServiceNow customers needing PMO support.

AIRTABLE

Airtable is strong for process and item management but weaker in project management. Airtable is a low-code provider whose strategy is to provide a flexible platform for citizen developers and business teams to build applications and support the development of business applications. Its differentiation allows end users to build process and project support without requiring custom code. Based in San Francisco since 2013, the company has a cross-industry customer base with an emphasis on high-tech, media, and retail. It’s experiencing healthy year-over-year growth. Airtable excels in supporting a company’s need for specific problem-solving solutions through the creation of work types and robust automation to support work at scale. Weaknesses include AI, ML, and portfolio management capabilities. Reference customers cite the ability to spin up bases for multiple use cases, very accessible training, and great vendor involvement as positives but want better interfaces, information accessibility, and enterprise controls. Airtable is a good choice for organizations seeking to build specific solutions on top of a common data model to solve common work problems.

MICROSOFT

Microsoft provides strong team-level support, but top-down planning is slim. Microsoft’s CWM approach emphasizes individuals and teams over formalized top-down planning. Its strategy is to leverage common products on a ubiquitous platform to connect people and the way they work to achieve collective goals. However, it has limited top-down planning capability to support enterprise work management. Globally positioned, Microsoft’s CWM offering is part of Office 365 that saw 10% revenue growth in FY2021. Microsoft’s strengths are the ability to integrate work with common work applications, manage complex projects, and provide global support. Weaknesses are workload management and integrated financial management. The product doesn’t support creation of work types from scratch, but Teams can leverage templates to support different work types. Reference customers feel that Viva Goals is a great addition to help focus teams and that form and document management is strong, as is project scheduling, but feel that reporting requires too much effort and that Planner doesn’t provide adequate team-level support. Microsoft is a good choice for enterprises needing general work management at the team level.

ATLASSIAN

Atlassian offers a wide range of solutions that focuses on teams over enterprises. Founded in 2002 in Sydney, Atlassian has continuously focused on the needs of teams working together. Historically focused on the needs of software developers with Jira and Confluence, the vendor has expanded to support business users with Trello and Jira Work Management. From a CWM perspective, the vendor’s decision to avoid enforcing enterprise standards to embrace team-level autonomy is a weakness in its strategy. It keeps the products best suited for team-level usage across a variety of work, especially with technical needs. Atlassian offers global support with an emphasis on high-tech products, consumer products, and professional services. Atlassian excels in knowledge management, integration, and cross-team connection. Weaknesses include lack of portfolio management capabilities, such as top-down capacity management and financial tracking. Reference customers liked the wide number of tool options to build a customized approach, self-service support, and the vendor’s responsiveness for serious issues. They felt that the product worked well with tech teams, but they continue to struggle with adoption with business users. And they felt that the vendor’s acquisition strategy unintentionally created gaps in the product for the end user. Atlassian is a good choice for connecting technical teams with business users on common work.

QUICKBASE

Quickbase targets support for complex projects but lacks ad hoc task management. Founded in 1999, Quickbase provides low-code solutions for a global audience. Emphasizing construction, engineering, healthcare, and retail industries, the vendor differentiates itself by targeting key information that supports the delivery of complex projects and programs. Headquartered in Boston, Quickbase has growth in its key verticals while investing in R&D to expand the product. Strategically, the vendor’s targeted audience has seen lower growth than pure-play vendors. However. expansion of CWM experiences should expose the vendor to a broader audience. Quickbase’s strengths are supporting work-type creation, applying AI/ML to support decisioning, and data accessibility. However, it lags in collaboration capabilities and knowledge management. Reference customers like the ability for end users to create their own work types and projects, project information support, and vendor support but cite reporting and mobile support as lacking. Quickbase is a good choice for organizations seeking to integrate project information management with project delivery.

CONTENDERS

CLICKUP

ClickUp has robust support for SMBs but has limited support for large enterprises. ClickUp, founded in 2017 and headquartered in San Diego, California, focuses on the needs of small and medium-size business (SMB) organizations with a variety of task and collaboration capabilities. The vendor differentiates itself through innovative ways of delivering flexible work environments to disparate teams within an organization as well as core work management and value-added apps to augment planning and delivery needs. Now in the third iteration of the product, ClickUp is starting to gain traction in larger companies, especially on the technical side. Its partner ecosystem lags relative to others’ evaluated. ClickUp excels in enabling clients to build a custom work environment without having to rely on custom code and offers productivity capabilities such as document management and whiteboarding. It has limited AI/ML capabilities, robust analytics, and ease of data accessibility. Reference customers say that the product brings a high joy factor, allowing them to onboard new users with low learning curves, but lacks form functionality, portfolio, and advanced reporting capabilities. ClickUp is a good choice for SMBs or departments in larger organizations to connect task management with supporting collaborative capabilities.

PLANVIEW CLARIZEN

Planview Clarizen offers a competent product emphasizing projects over ad hoc work. Planview acquired Clarizen in 2020 to strengthen its presence in the PPM and CWM markets. Now known as Planview Adaptive Work, it differentiates itself as an easy-to-use project management solution for marketing, IT, and general business use. While it can be configured to support nonproject work, the out-of-the-box capabilities target project management capabilities. Emphasizing consumer products and financial and professional services primarily in North America and EMEA, the product has seen consistent revenue growth. It is strategically expanding to connect the work lifecycle from ideation to delivery. Planned enhancements and partner ecosystems are a weakness. Planview Clarizen excels in collaboration with strong content management, project management, and work analytics. Weaknesses include a lack of end-user automation capabilities, portfolio support, and knowledge management. Reference customers like the configurability of the product to support different project approaches, robust data management, and reporting but would like stronger out-of-the-box agile support. They also find that support has been less responsive since the acquisition. Planview is a good choice for enterprises needing straightforward project organization and collaboration.

CANOPY CLOUD

CanopyCloud provides capable project management but targets a specific market. The vendor, part of the Inspired Thinking Group out of the UK, offers robust project management capabilities for marketing and supporting organizations. The vendor, targeting high-tech products, professional services, and retail across the globe, differentiates itself by helping clients devise the workflows and automation needed to deliver marketing and branding requirements in a single source of truth. With healthy investment in R&D, the vendor is consistently profitable and continues to plan for global growth. With marketing as the vendor’s primary focus, its product vision, innovation roadmap, and partner ecosystem remain narrow, even though the vendor can support ad hoc or other types of work management needs. CanopyCloud’s strengths are availability of project management capabilities, ability to manage work at scale, and complex project management support. Weaknesses are the lack of ad hoc work support, end-user automation, and AI/ML capabilities. Reference customers cite outstanding marketing project management support, strong vendor support, and the potential for additional use cases. They would like it to improve action-oriented notifications and dynamic workflows. CanopyCloud is a good choice for marketing organizations needing robust marketing project management.

Evaluation Overview

We evaluated vendors against 30 criteria, which we grouped into three high-level categories:

Current offering

Each vendor’s position on the vertical axis of the Forrester Wave graphic indicates the strength of its current offering. Key criteria for these solutions include creation of work types, ability to manage complex projects, manage work at scale, AI/ML, and knowledge management.

Strategy

Placement on the horizontal axis indicates the strength of the vendors’ strategies. We evaluated product vision, execution roadmap, innovation roadmap, and partner ecosystem.

Market presence

Represented by the size of the markers on the graphic, our market presence scores reflect each vendor’s revenue, average deal size, and number of live installations.

Vendor inclusion criteria

Forrester included 13 vendors in the assessment: Adobe, Airtable, Asana, Atlassian, CanopyCloud, ClickUp, Microsoft, monday.com, Planview, Quickbase, ServiceNow, Smartsheet, and Wrike.

Global language and currency support. Vendors were required to have global language support for more than eight languages and currencies and the ability to support a global client base.

Out-of-the-box support for at least four defined use cases in Forrester’s CWM landscape. In the Forrester CWM landscape, we defined five use cases: project management, agile project management, OKR management, strategy planning, and marketing campaign management. Participating vendors had to have out-of-the-box functionality to support at least four use cases.

Annual recurring revenue (ARR) of $50 million or more. Participating vendors had to report at least $50 million in ARR.

Supplemental material

We publish all our Forrester Wave scores and weightings in an Excel file that provides detailed product evaluations and customisable rankings; download this tool by visiting www.forrester.com (this may be subject to T&Cs). We intend these scores and default weightings to serve only as a starting point and encourage readers to adapt the weightings to fit their individual needs.

The Forrester Wave methodology

A Forrester Wave is a guide for buyers considering their purchasing options in a technology marketplace. To offer an equitable process for all participants, Forrester follows The Forrester Wave™ Methodology Guide to evaluate participating vendors.

In our review, we conduct primary research to develop a list of vendors to consider for the evaluation. From that initial pool of vendors, we narrow our final list based on the inclusion criteria. We then gather details of product and strategy through a detailed questionnaire, demos/briefings, and customer reference surveys/interviews. We use those inputs, along with the analyst’s experience and expertise in the marketplace, to score vendors, using a relative rating system that compares each vendor against the others in the evaluation.

We include the Forrester Wave publishing date (Q4 2022) clearly in the title of each Forrester Wave report. We evaluated the vendors participating in this Forrester Wave using materials they provided to us by August 18, 2022, and did not allow additional information after that point. We encourage readers to evaluate how the market and vendor offerings change over time.

In accordance with The Forrester Wave™ And New Wave™ Vendor Review Policy, Forrester asks vendors to review our findings prior to publishing to check for accuracy. Vendors marked as nonparticipating vendors in the Forrester Wave graphic met our defined inclusion criteria but declined to participate in or contributed only partially to the evaluation. We score these vendors in accordance with The Forrester Wave™ And The Forrester New Wave™ Nonparticipating And Incomplete Participation Vendor Policy and publish their positioning along with those of the participating vendors.

Integrity Policy

We conduct all our research, including Forrester Wave evaluations, in accordance with the Integrity Policy posted on www.forrester.com.