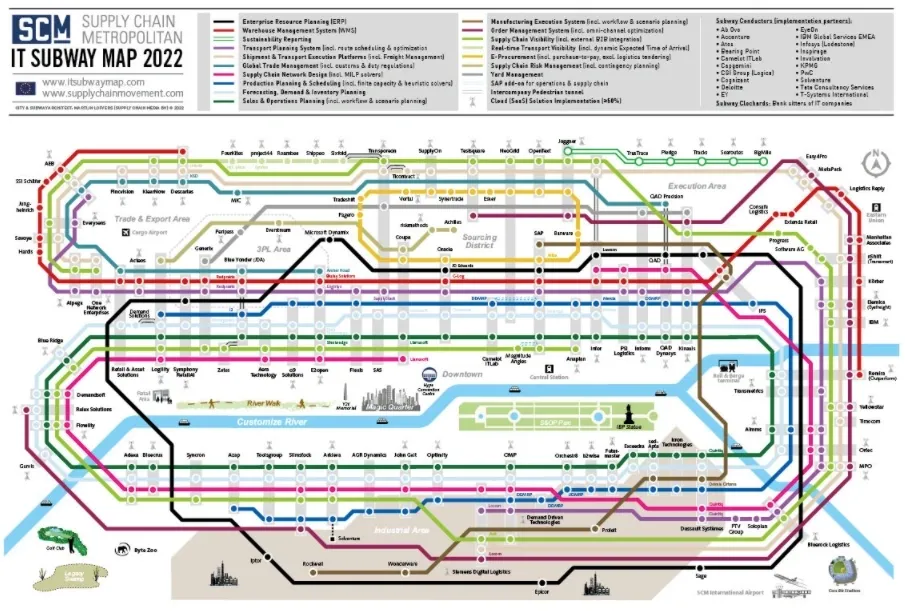

Getting and maintaining a good insight into the fast developing landscape of supply chain technology solutions is extremely difficult. Products are rapidly developing horizontally and vertically. This IT Subway map is a great tool to keep a grip on what’s going on.

Supply chain software vendors have the wind at their backs in Europe, mainly due to the numerous disruptions and the need for companies to digitally transform. One positive effect of the COVID-19 pandemic has been the growth in working from home and remote working. Supply chain visibility solutions appear to be in greatest demand in Europe, according to research by Supply Chain Media among 54 software vendors for the twelfth edition of the SCM IT Subway Map Europe.

More than two-thirds of the supply chain software vendors surveyed expect to complete more implementations this year than last, compared with only 38% two years ago. An overwhelming 87% think they will generate more revenue this year than last. That could not be said for any company two years ago, when they were caught up in the early stages of the pandemic. Three quarters of the respondents now have more employees, in contrast with only a third who said that one year ago. In addition to the increased need for supply chain software, the success of working from home is a major contributor to the current prosperity of vendors. Of the software companies themselves, 57% say they are working from home more than a year ago, while the rest say there has been little change. 44% of the software vendors’ customers are also working from home more. As a downside, a handful of software vendors indicate that it is more difficult to sell supply chain software at online meetings than live ones.

Lots of acquisitions

Vendors of real-time transport visibility software have been particularly successful recently, so they are on the hunt for acquisition candidates to broaden their portfolios. Project44 now offers additional functionality in the area of yard management and has also recently acquired Synfioo, a German visibility specialist in European rail and barge freight. Meanwhile, US-based competitor FourKites has taken over NIC-place, a German provider of solutions for the secure transmission of logistics data. The German logistics player Transporeon has recently made a series of acquisitions: Logit One in the field of ocean freight visibility, Sixfold which is an Austrian provider of real-time transport visibility, the Belgian TMS provider SupplyStack and Hungary’s Nexogen, a logistics specialist in artificial intelligence. The acquisition by E2open – another US software vendor – of Logistyx Technologies has gained the firm an advanced TMS solution, and this comes hot on the heels of its acquisition of broad cloud-based solutions provider BluJay Solutions. nShift is a new name on the map, resulting from the merger of Dutch software vendor Transsmart with Swedish vendors Unifaun and Returnado and Norway’s Consignor. Meanwhile, German supply chain software provider Remira is merging with German omni-channel software provider Roqqio, having previously acquired Dutch S&OP specialist Outperform a year ago.

Mapping sustainability

In addition to these acquisitions, the most important addition to the twelfth edition of the SCM IT Subway Map Europe is the new subway line for Supply Chain Sustainability Reporting, i.e. the detailed registration of CO2 emissions. Supply Chain Media has visually incorporated all the above-mentioned developments in the European supply chain software market into this twelfth edition of the SCM IT Subway Map Europe. Based on their input, including the number of live customers in Europe and the share of turnover per software type, software vendors have been assigned the relevant number of subway stations to indicate their proven areas of expertise in Europe.

Besides the SCM IT Subway Map in Supply Chain Movement’s magazine and on the enclosed poster, Supply Chain Media has developed a clickable and updated online version showing the European supply chain software market – click here to view.